Unlocking the Secrets of Ichimoku Cloud Trading Signals

# Mastering Ichimoku Cloud Trading Signals

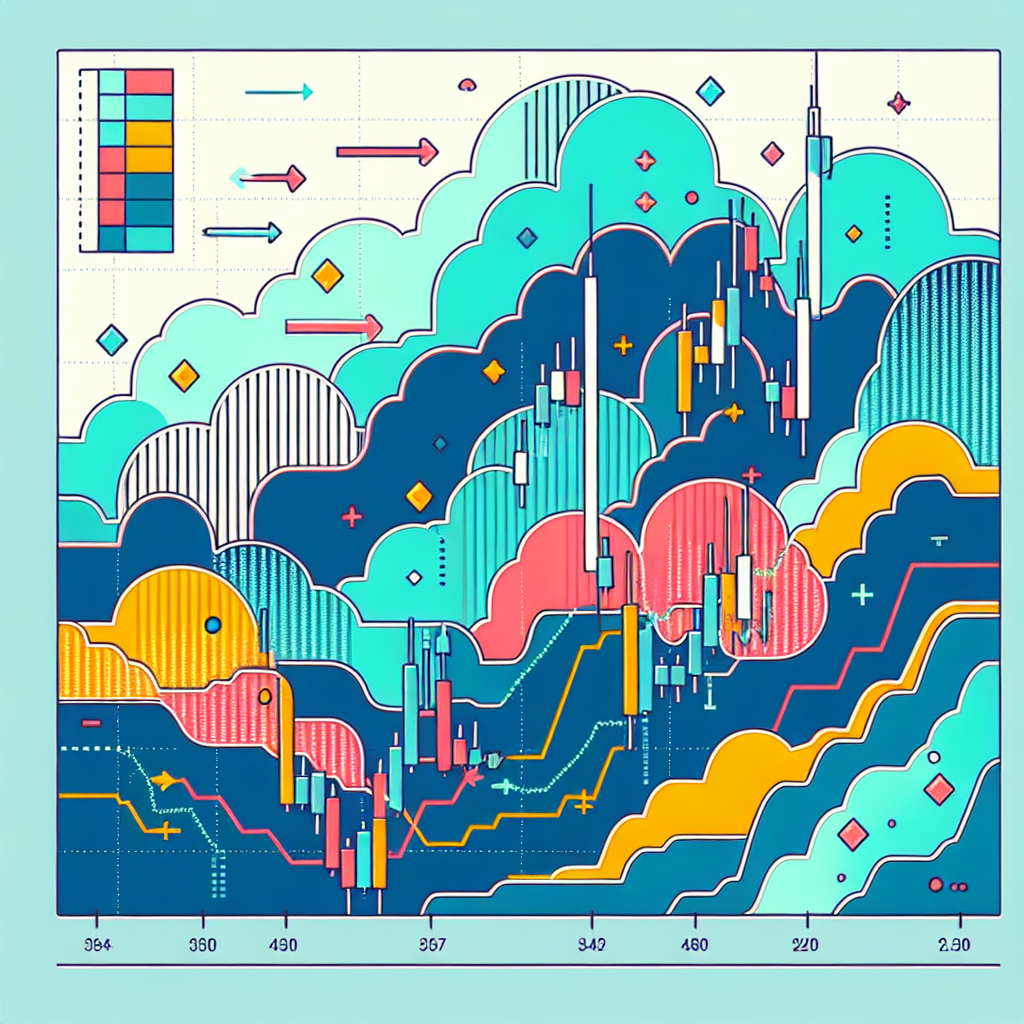

The Ichimoku Cloud, or Ichimoku Kinko Hyo, is a comprehensive indicator that defines support and resistance, identifies trend direction, gauges momentum, and provides trading signals. It is a one-glance equilibrium chart that provides a dense and yet insightful visual representation of the market. In this article, we dive deep into understanding how to interpret and trade using the Ichimoku Cloud signals.

An Introduction to Ichimoku Cloud

The Ichimoku Cloud consists of five main components that work together to paint a thorough picture of the market’s action. These are the Tenkan-sen (Conversion Line), Kijun-sen (Base Line), Senkou Span A (Leading Span A), Senkou Span B (Leading Span B), and the Chikou Span (Lagging Span). Together, they form the “cloud” that predicts potential price movements.

Key Ichimoku Signals

Trading with the Ichimoku Cloud involves understanding how its five components interact to produce buy or sell signals. These signals are vital for spotting trend reversals and continuations.

The Kumo (Cloud) Breakout

A primary signal for Ichimoku traders is the Kumo breakout, where the price moves above or below the cloud. A bullish signal occurs when the price breaks above the cloud, suggesting a long position. Conversely, a break below indicates a bearish trend, recommending a short position.

The TK Cross

The TK Cross involves the Tenkan-sen and Kijun-sen lines. A bullish signal is generated when the Tenkan-sen crosses above the Kijun-sen, especially if this occurs above the cloud. A bearish signal, however, occurs when the Tenkan-sen crosses below the Kijun-sen under the cloud.

Kumo Twist

The Kumo or cloud twist occurs when Senkou Span A crosses Senkou Span B, leading to a change in the cloud’s color. This is a forward-looking indicator of potential trend changes. A green cloud indicates bullish momentum, while a red cloud signals bearish momentum.

Chikou Span Confirmation

The Chikou Span acts as a momentum indicator. A bullish signal is reinforced if the Chikou Span is above the price from 26 periods ago. Conversely, it confirms a bearish signal if it is below the price from the same period.

Trading Strategies with Ichimoku Cloud

To effectively harness the signals provided by the Ichimoku Cloud, traders typically combine several indicators to confirm trends and entries.

Combining the TK Cross and Kumo Breakout

One popular strategy is to wait for a TK cross to occur in conjunction with a Kumo breakout. This tends to be a stronger signal than either event happening independently.

Using the Kumo for Stop-Losses

The edges of the Kumo can serve as dynamic support or resistance levels. Traders often place stop-loss orders just beyond these boundaries to protect against significant losses.

Filtering with the Chikou Span

Before entering a trade based on other signals, look at the Chikou Span’s position relative to past price action. It can help filter out less promising setups by confirming the overall momentum is in your favor.

Risks and Considerations

While the Ichimoku Cloud offers comprehensive insights, it’s not foolproof. Markets can remain irrational longer than anticipated, leading to false signals. It’s crucial to combine Ichimoku strategies with sound risk management practices, like setting stop losses and only risking a small percentage of your trading capital on individual trades.

Conclusion

The Ichimoku Cloud is a powerful tool in the trader’s arsenal, offering a multi-dimensional view of the market. Its strength lies in its ability to provide a clear picture of the market sentiment at a glance. By mastering the Ichimoku signals and combining them with prudent trading strategies, traders can navigate the markets with greater confidence. However, like any trading system, it requires practice, patience, and a strong risk management strategy to be effective.