Interpreting MACD Histogram: A Guide for Traders

Understanding MACD Histogram Interpretations

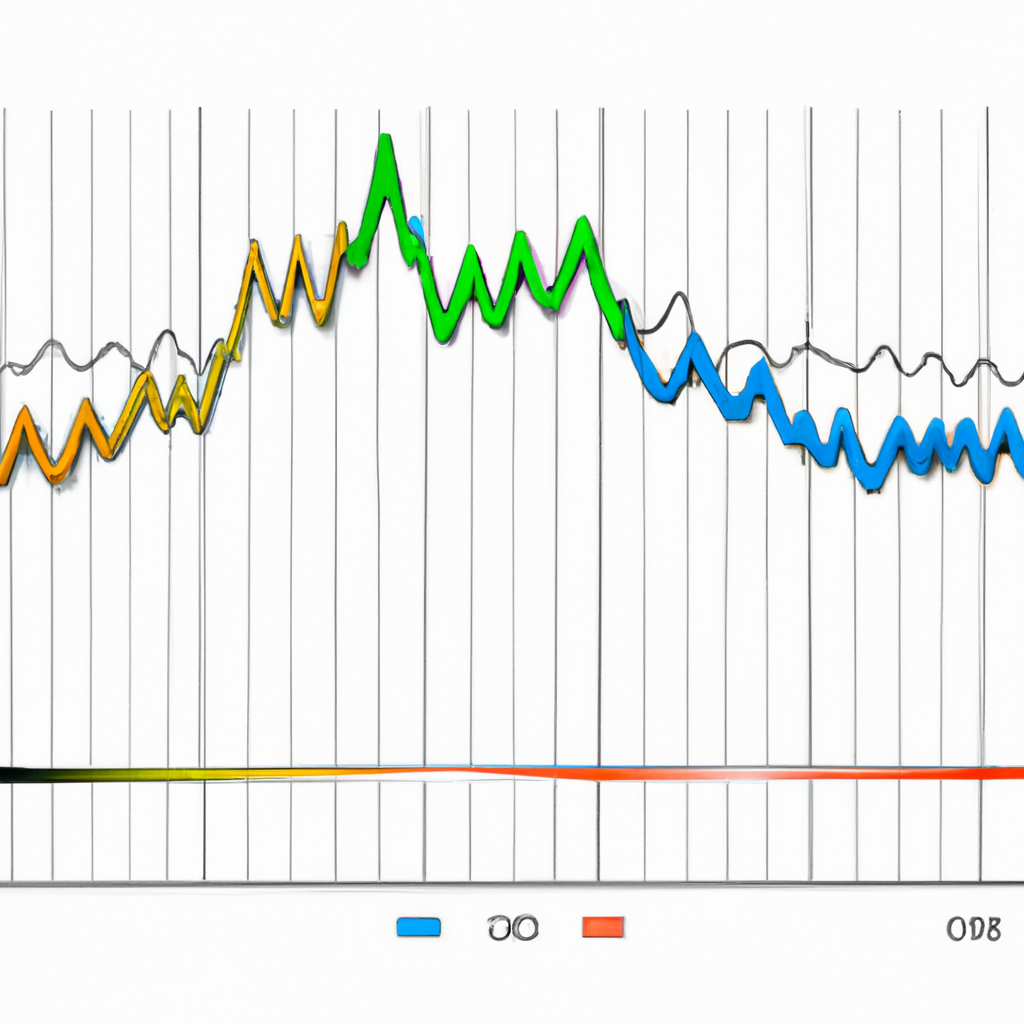

The Moving Average Convergence Divergence (MACD) histogram is a popular technical indicator used by traders to identify potential buy or sell signals in the market. The histogram is derived from the MACD line and signal line, which are both based on moving averages. Understanding how to interpret the MACD histogram can help traders make informed decisions when trading.

Interpreting Positive Histogram Bars

When the MACD histogram bars are above the zero line and increasing in size, it indicates that the bullish momentum is strengthening. Traders may interpret this as a signal to enter a long position or hold onto existing long positions. The larger the positive histogram bars, the stronger the bullish momentum is believed to be.

Interpreting Negative Histogram Bars

Conversely, when the MACD histogram bars are below the zero line and decreasing in size, it indicates that the bearish momentum is strengthening. Traders may interpret this as a signal to enter a short position or hold onto existing short positions. The larger the negative histogram bars, the stronger the bearish momentum is believed to be.

Interpreting Crossovers

One of the most common signals generated by the MACD histogram is a crossover between the MACD line and the signal line. When the MACD line crosses above the signal line, it is considered a bullish signal. Conversely, when the MACD line crosses below the signal line, it is considered a bearish signal. Traders may use these crossovers as entry or exit points for their trades.

Interpreting Divergences

Another important aspect of interpreting the MACD histogram is looking for divergences between the price action and the histogram. A bullish divergence occurs when the price makes lower lows, but the MACD histogram makes higher lows. This can indicate a potential reversal to the upside. On the other hand, a bearish divergence occurs when the price makes higher highs, but the MACD histogram makes lower highs. This can indicate a potential reversal to the downside.

Using the MACD Histogram in Conjunction with Other Indicators

While the MACD histogram can be a powerful tool on its own, traders often use it in conjunction with other technical indicators to confirm signals. For example, traders may look for confirmation from other indicators such as the Relative Strength Index (RSI) or the Moving Average to strengthen their trading decisions.

By understanding how to interpret the MACD histogram and using it in conjunction with other indicators, traders can make more informed trading decisions and potentially improve their overall trading performance.