Exploring the Power of Fibonacci Retracement Levels in Trading

Understanding Fibonacci Retracement Levels

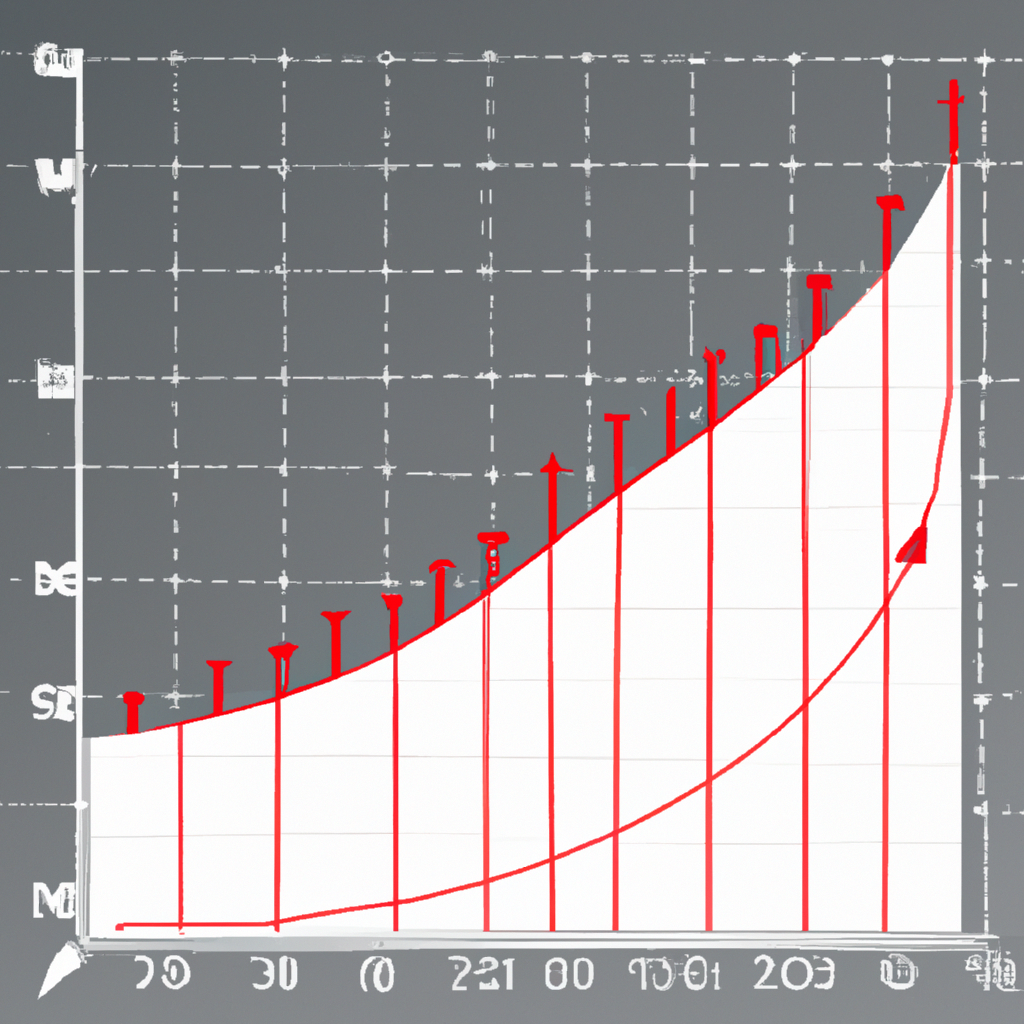

Fibonacci retracement levels are a popular technical analysis tool used by traders to identify potential support and resistance levels in financial markets. These levels are based on the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones (e.g. 0, 1, 1, 2, 3, 5, 8, 13, etc.).

How Fibonacci Retracement Levels are Calculated

To calculate Fibonacci retracement levels, traders typically identify a significant price move (either up or down) and then apply the Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 100%) to that move. These levels are then used to predict potential levels of support or resistance where the price may reverse.

Using Fibonacci Retracement Levels in Trading

Traders use Fibonacci retracement levels in a variety of ways, including:

- Identifying potential entry points: Traders may look to enter a trade when the price retraces to a Fibonacci level, expecting a bounce back in the direction of the original trend.

- Setting stop-loss orders: Traders may place stop-loss orders below a Fibonacci retracement level to limit potential losses if the price moves against their position.

- Identifying profit targets: Traders may use Fibonacci retracement levels to identify potential profit targets for their trades, based on historical price movements.

Limitations of Fibonacci Retracement Levels

While Fibonacci retracement levels can be a useful tool for traders, it’s important to remember that they are not foolproof. Markets can be unpredictable, and price movements may not always adhere to Fibonacci ratios. It’s also important to use Fibonacci retracement levels in conjunction with other technical analysis tools and indicators to confirm potential trading signals.

Conclusion

Fibonacci retracement levels are a valuable tool for traders looking to identify potential support and resistance levels in financial markets. By understanding how to calculate and use these levels effectively, traders can improve their trading strategies and make more informed decisions when entering and exiting trades.