Exploring Advanced Candlestick Patterns for Trading

# Mastering Advanced Candlestick Patterns for Improved Market Analysis

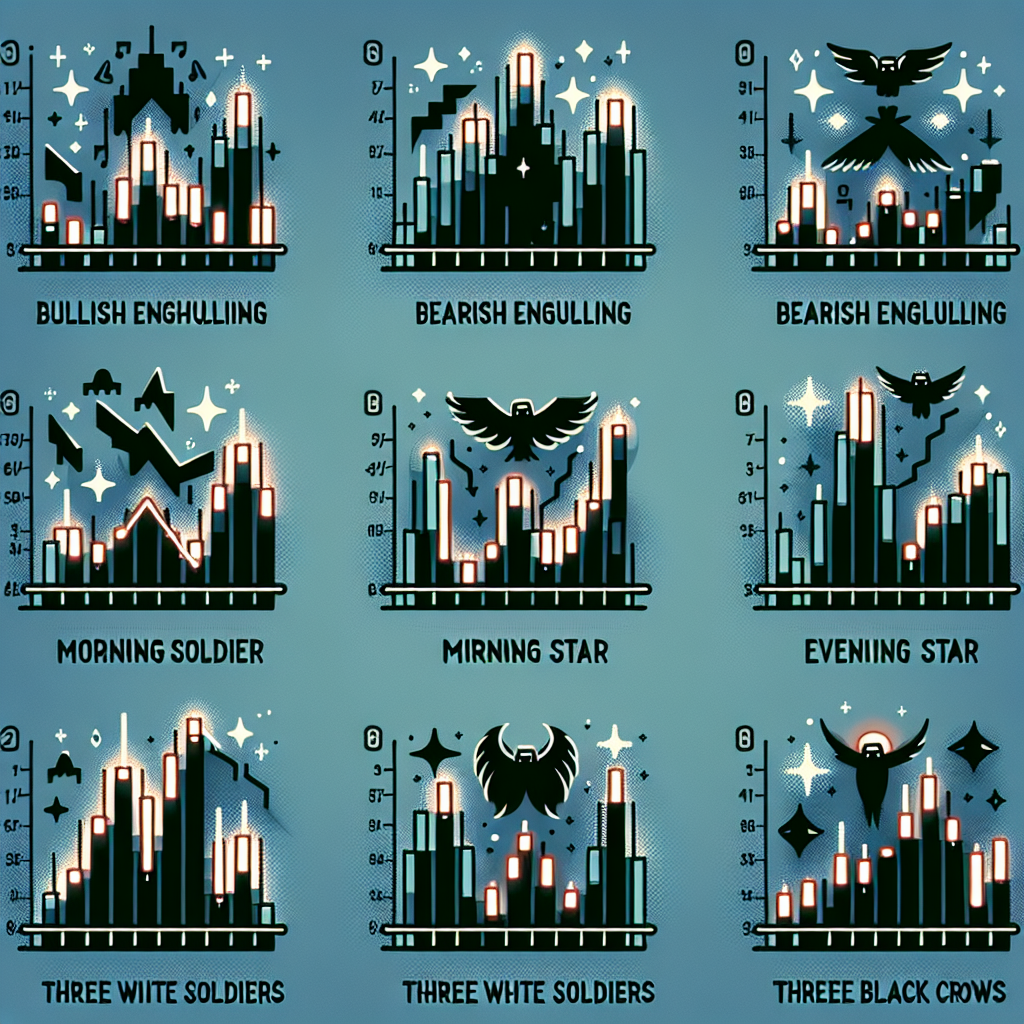

Candlestick patterns are a cornerstone of technical analysis, providing invaluable insights into market sentiment and potential price movements. While basic patterns can offer significant clues to short-term price actions, advanced candlestick patterns afford traders a deeper understanding of market dynamics, helping to predict future movements with greater accuracy. This article delves into some of the most potent advanced candlestick patterns, highlighting how traders can harness their power for more informed trading decisions.

Introduction to Advanced Candlestick Patterns

Advanced candlestick patterns are formed over three or more trading sessions, unlike their simpler counterparts that develop over one to two sessions. These patterns are indicative of a stronger market sentiment and can be pivotal in forecasting market reversals or continuations. Recognizing and interpreting these configurations can significantly enhance trading strategies, making it essential for traders to familiarize themselves with these complex formations.

Three Black Crows

The Three Black Crows is a bearish reversal pattern that materializes at the peak of an uptrend. It consists of three consecutive long-bodied, bearish candles, each opening within the body of the previous candle and closing near its low. This pattern signals a shift from bullish to bearish sentiment, suggesting that prices may continue to fall.

Interpretation and Trading Strategy

The appearance of the Three Black Crows suggests strong selling pressure and a lack of buyer interest. Traders might consider this an opportunity to initiate short positions or exit long positions. The pattern is confirmed if the following candle closes lower, reinforcing the bearish outlook.

Bullish and Bearish Engulfing Patterns

Engulfing patterns are two-candle formations that signal potential reversals in the market. A Bullish Engulfing pattern forms at the end of a downtrend, where a small bearish candle is followed by a large bullish candle that completely engulfs the body of the previous candle. Conversely, a Bearish Engulfing pattern occurs at the end of an uptrend, characterized by a small bullish candle followed by a large bearish candle that engulfs the first.

Interpretation and Trading Strategy

The Engulfing patterns indicate a strong shift in market sentiment. In the case of a Bullish Engulfing, traders might consider buying or covering short positions, especially if subsequent candles confirm upward momentum. For a Bearish Engulfing, selling or shorting could be advantageous if followed by further downward movement.

The Morning Star and Evening Star Patterns

The Morning Star and Evening Star patterns are triple-candle formations that signal reversals. The Morning Star, indicative of a bullish reversal, consists of a long bearish candle, a short-bodied candle or doji that gaps lower, followed by a long bullish candle that closes within the gap of the first candle. The Evening Star pattern, suggesting a bearish reversal, mirrors this structure but in reverse order.

Interpretation and Trading Strategy

The Morning Star pattern signals weakening of the bearish trend and a potential bullish reversal. Traders could consider taking long positions once the third candle confirms the reversal. The Evening Star, however, warns of a bearish reversal after a bullish trend. Establishing short positions or closing longs might be wise after confirmation.

The Importance of Confirmation

While advanced candlestick patterns are powerful tools, they are not foolproof. Confirmation through additional technical indicators or subsequent candle closes is crucial for increasing the reliability of these patterns. Volume analysis, RSI, and moving averages can provide complimentary insights, enhancing the accuracy of predictions based on candlestick patterns.

Conclusion

Advanced candlestick patterns offer a sophisticated lens through which to view market sentiment, serving as a critical component of a comprehensive trading strategy. By understanding and applying these patterns, traders can make more informed decisions, capitalizing on potential market reversals and continuations. However, the true power of these patterns is unlocked through practice and combined analysis, highlighting the need for a holistic approach to market analysis.