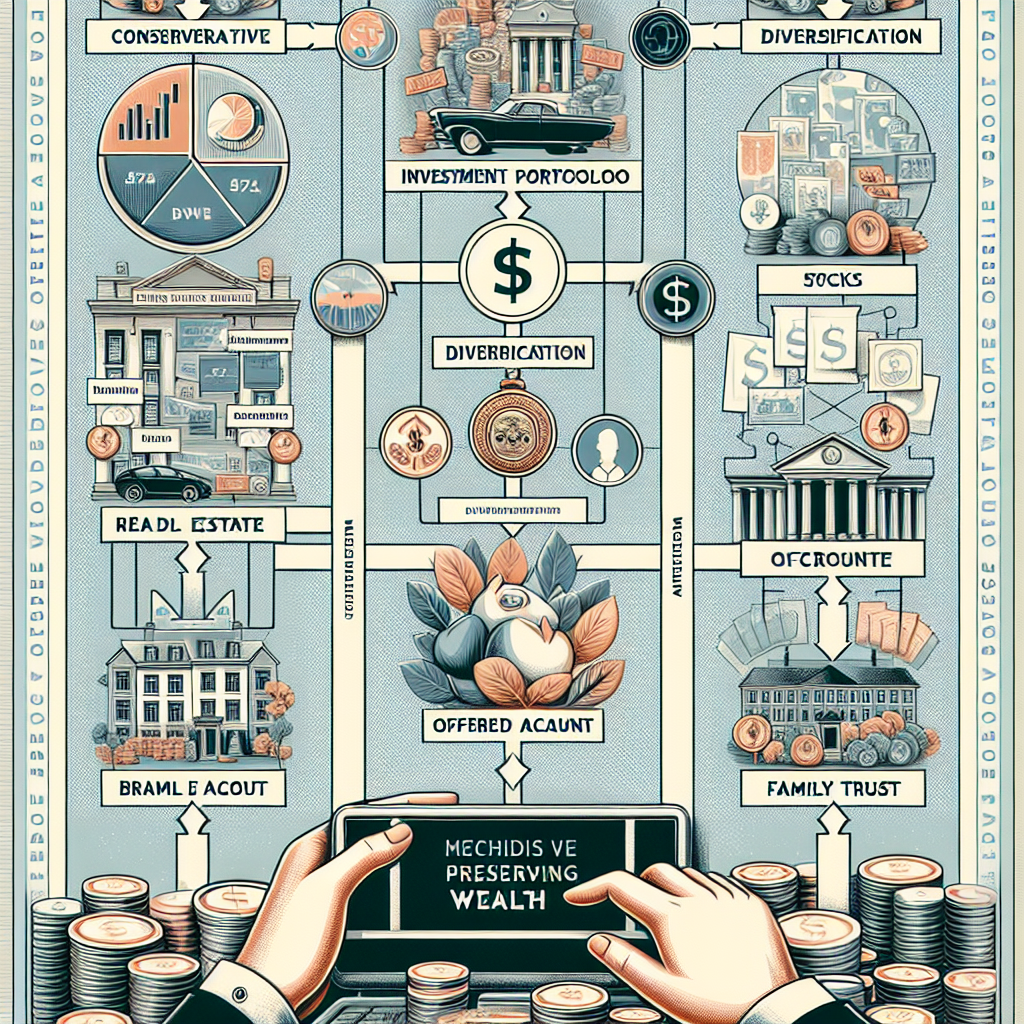

Effective Strategies for Preserving Your Wealth

Wealth Preservation Techniques

In an ever-evolving financial landscape, the significance of wealth preservation cannot be overstated. As individuals and families accumulate wealth, safeguarding it from various risk factors becomes paramount. This article delves into effective strategies and techniques aimed at preserving wealth for current and future generations.

Understanding the Fundamentals of Wealth Preservation

Wealth preservation encompasses strategies to protect assets from erosion due to inflation, taxes, litigation, and other financial risks. It’s about maintaining the real value of your assets, ensuring that your wealth sustains your lifestyle, meets future needs, and fulfills legacy goals.

Strategic Allocation of Assets

Diversification across Asset Classes

Diversifying your investment portfolio across various asset classes such as stocks, bonds, real estate, and precious metals can mitigate risk. A well-diversified portfolio can reduce the impact of market volatility, as different assets react differently to economic events.

Geographical Diversification

Investing in markets outside your home country can offer not just growth opportunities but also serve as a hedge against domestic economic downturns and currency devaluation. However, it’s crucial to understand the risks involved, including political and exchange rate risks.

Utilizing Trusts for Asset Protection

Revocable vs. Irrevocable Trusts

Trusts can be an effective tool in estate planning and asset protection. Revocable trusts offer flexibility as you can modify its terms or dissolve it during your lifetime. However, for genuine asset protection, irrevocable trusts are more effective as the assets transferred out of your direct control and, therefore, beyond the reach of creditors and legal judgments.

Deciding on the Right Type of Trust

The appropriate trust structure depends on your specific needs, whether it’s safeguarding assets for future generations, donating to charity, or minimizing estate taxes. Consulting with an estate planning attorney is essential to tailor the right trust strategy for you.

Employing Tax-Efficient Investing Strategies

Taxes can significantly erode wealth if not carefully managed. Employing tax-efficient strategies such as maximizing contributions to retirement accounts, investing in tax-exempt bonds, or utilizing tax-advantaged accounts can protect your wealth from unnecessary tax burdens.

Insurance as a Wealth Protection Mechanism

Life Insurance

Beyond its traditional role, life insurance can be a strategic part of wealth preservation. It can provide a tax-free inheritance to beneficiaries, serve as collateral for loans, and, in the case of permanent life insurance policies, offer a cash value component as an additional asset.

Umbrella Insurance Policies

Umbrella insurance provides extra liability coverage beyond the limits of standard insurance policies. It can protect against major claims and lawsuits, offering another layer of security for your wealth.

Regular Review and Adjustment

Wealth preservation is not a set-it-and-forget-it endeavor. Regular review of your financial plan, investment portfolio, and estate documents ensures that your wealth preservation strategies align with changing laws, economic conditions, and personal circumstances.

Conclusion

Wealth preservation is a multifaceted discipline that requires proactive management and strategic planning. By employing a combination of asset allocation, estate planning, tax strategies, and insurance, you can safeguard your wealth against unforeseen risks and ensure its longevity for generations to come. Collaborating with financial and legal professionals can provide tailored advice and peace of mind through this complex process.