Unlocking the Potential of Elliott Wave Forecasting Models

Elliott Wave Forecasting Models

What is Elliott Wave Theory?

Elliott Wave Theory is a method of technical analysis that attempts to predict future price movements based on crowd psychology. It was developed by Ralph Nelson Elliott in the 1930s and is based on the premise that market prices move in repetitive patterns.

How Does Elliott Wave Theory Work?

According to Elliott Wave Theory, market prices move in waves that can be divided into two categories: impulsive waves and corrective waves. Impulsive waves move in the direction of the overall trend, while corrective waves move against the trend.

Key Concepts of Elliott Wave Theory

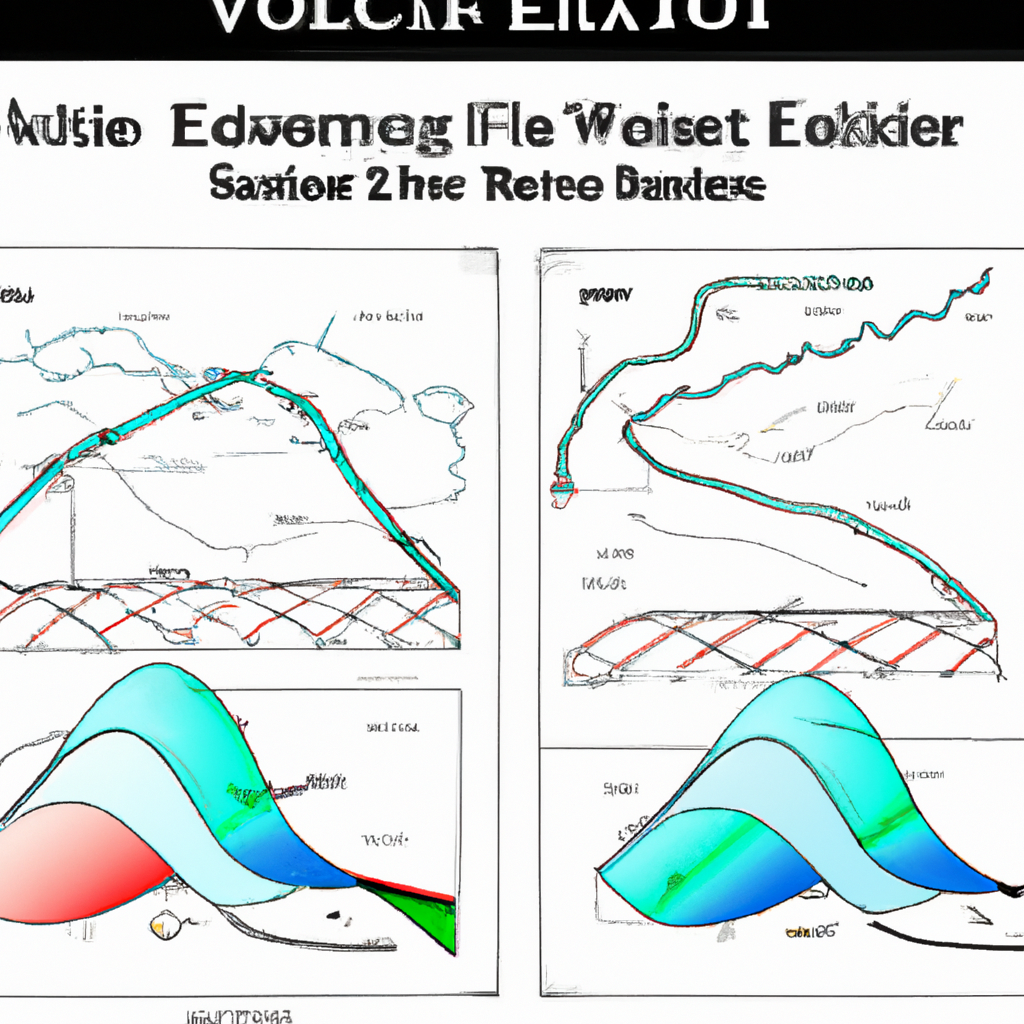

– Five-wave impulsive moves: Impulsive waves consist of five sub-waves, labeled 1, 2, 3, 4, and 5. Waves 1, 3, and 5 move in the direction of the trend, while waves 2 and 4 correct the preceding waves.

– Three-wave corrective moves: Corrective waves consist of three sub-waves, labeled A, B, and C. Wave A moves against the trend, wave B corrects wave A, and wave C moves in the direction of the trend.

Forecasting with Elliott Wave Theory

Elliott Wave Theory can be used to forecast future price movements by identifying the current wave count and projecting the next wave. Traders and analysts use various tools and techniques to analyze market data and identify potential wave patterns.

Challenges of Elliott Wave Forecasting

While Elliott Wave Theory can be a powerful tool for forecasting market trends, it is not without its challenges. One of the main challenges is the subjective nature of wave analysis, as different analysts may interpret wave patterns differently. Additionally, market conditions can be unpredictable, making it difficult to accurately forecast future price movements.

Conclusion

Elliott Wave Theory is a popular method of technical analysis that can be used to forecast future price movements in financial markets. By understanding the key concepts and principles of Elliott Wave Theory, traders and analysts can make more informed decisions when trading or investing. However, it is important to remember that no forecasting method is foolproof, and market conditions can change rapidly.